The known: Private equity ownership of health care assets has increased in many countries. In the United States, it has been associated in some cases with higher costs and increased mortality.

The new: Private equity firms made at least seventy‐five acquisitions of health care delivery assets in Australia during 2008–2022, at a total cost of at least $24 billion; the number of identified acquisitions rose from three in 2008 to eighteen in 2022.

The implications: Private equity is increasingly important in Australian health care, and the implications of this development should be investigated. Doctors should be cognisant of the nature of private equity interests when interacting with potential buyers or private equity‐controlled assets.

Private equity firms are investment firms that accept money from institutional investors (eg, pension funds) to purchase stakes in or buy companies outright for the purpose of later selling or publicly listing the company for profit. Private equity investors around the world have become increasingly interested in health care delivery assets. In the United States, the number of identified private equity acquisitions of medical practices grew from 39 in 2010 to 167 organisations in 2020.1 Despite media commentary on increasing private equity investment in health care in Australia, little has been done to investigate its scale or effects on health care delivery.

Understanding the impact of private equity ownership is important given the evidence for its effects on health care prices, care quality, workforce composition, and medical referrals in the United States.1,2,3,4 These effects are thought to be driven by the ownership dynamics of private equity firms. Private equity owners apply various strategies to increase the value of their assets before selling them, including investing in new infrastructure, changing management practices to reduce costs and increase income, and adding further assets to increase the size of the organisation. These changes are undertaken quickly, as private equity investors are typically expected to sell their assets within three to seven years to generate prompt returns for their investor partners.5

Studies in the United States have reported that private equity ownership can be associated with changes in care delivery and negative effects on quality of care. In a qualitative study of private equity‐owned dermatology clinics, doctors reported pressure to undertake procedures, sell products, refer patients within their own networks, rely on lower paid staff to complete work, and maximise charges in billing offices.4 A quantitative study of private equity‐owned dermatology practices found that prices for services increased after their acquisition, but not procedure numbers.3 Charge‐to‐cost ratios and operating margins increased in hospitals after private equity acquisition, suggesting a focus on greater profitability.6

The impact of private equity on quality of care is also important. In the United States, private equity ownership was associated with a short term increase in mortality in nursing homes of 10%.7 The impact on hospitals is less clear; one short term study reported mixed results, including a small reduction in mortality after acute myocardial infarction,2 another retrospective study found higher rates of hospital‐acquired adverse events compared with matched control hospitals.8

Private equity ownership can also benefit doctors and health care services. Some doctors may find private equity acquisition of their clinic an attractive retirement option.9 The capital boost brought by private equity acquisition can enable services to make new investments, and may allow them to better compete in an increasingly challenging environment.10 Increased size can have economic benefits, including broader referral networks and greater bargaining power with suppliers. Doctors may be happy for private equity firms to relieve them of administrative responsibilities, allowing them to focus on medical practice.9

Understanding the scale and focus of private equity investment in health care delivery in Australia is important. Knowing where investment is directed can help policymakers and researchers assess its implications for health care delivery. Understanding the role, scale, focus, and motivation of private equity investors can inform decisions by doctors when they are approached by private equity buyers or their parent company is purchased.

In this article, I examine the scale of private equity investment in health care delivery assets (clinics, hospitals, imaging facilities, other doctor‐led health care services) in Australia, based on information from a commercial database and online media sources.

Methods

Private equity acquisitions during the 2008–2022 calendar years were identified in the PitchBook database (https://pitchbook.com). PitchBook is a market intelligence firm that tracks corporate mergers and acquisitions, including in health care. It collects data both automatically and manually from a range of sources, verified by an in‐house team.11 The PitchBook database has been a primary source of information about private equity acquisitions in health care for several studies.6,10,12

The search criteria identified private equity acquisitions of hospitals and outpatient services with headquarters in Australia, including primary and add‐on acquisitions (acquisitions in which the target becomes part of the entity that acquires it). This acquisitions list was cross‐checked against the results of a broader search that included the keyword “medical” to identify other relevant acquisitions not identified by the initial search (further details: Supporting Information). “Acquisition” was defined as a buy‐out or leveraged buy‐out, and excluded growth or expansion capital provided by a private equity firm.

Each acquisition (ie, completed sale) was verified by consulting publicly available press releases and media. Additional acquisitions identified during verification were included; if the cancellation of an agreed acquisition was reported, it was excluded; however, acquisitions before the end of 2022 were included if the sales contracts had been signed, but the sale had not yet been finalised. Each sale of a company purchased several times during 2008–2022 was included separately, including in clinic counts. Acquisitions were excluded if the entity involved did not identify doctors as playing a primary role in care delivery (eg, occupational rehabilitation and therapy services in which doctor services were not the business focus), aged care providers, disability services, and dental services.

The first year included was 2008, as it was the first year with more than one eligible acquisition. Acquisition dates and values were obtained from PitchBook, or from public information when available; sale prices not included in PitchBook were included if they were published in a reputable organ (eg, Australian Financial Review). Values are reported in Australian dollars; when values were provided in US dollars, they were converted to Australian dollars (conversion rate, US$1 = AU$1.48; Reserve Bank of Australia [https://www.rba.gov.au/statistics/historical‐data.html], 3 March 2023). Values were converted using rates at a single time point to allow comparisons between time periods (when relevant, US dollar values in PitchBook reflect exchange rates at the time of the transaction).

Companies were classified as hospitals, clinics, imaging services, or in vitro fertilisation providers. When hospitals were the major component of an acquisition, but the acquisition also included clinics, it was classified as a hospital acquisition. One doctor‐on‐call service was classified as a general practice clinic.

The numbers of clinics purchased as part of a single parent company during 2017–2022 were identified from publicly available information such as press releases; reliable numbers prior to this period were not available. When possible, the numbers were obtained from contemporaneous sources to ensure further acquisitions were not counted twice. When contemporaneous information was not available, acquisitions at and after the time of the initial purchase were distinguished using available information as far as possible. When companies had both Australian and overseas clinics, only the Australian clinics were counted.

Ethics approval

Formal ethics approval was not sought for this study.

Results

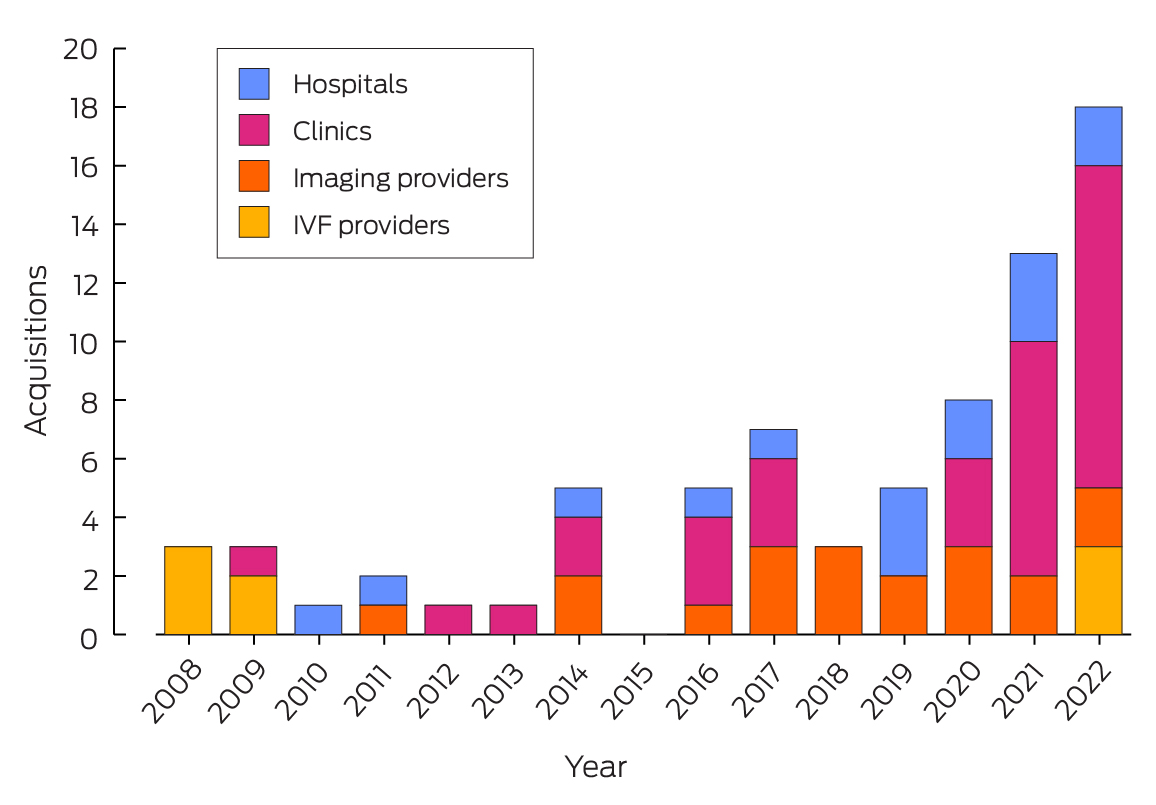

A total of 75 private equity acquisitions of health care delivery assets in Australia during 2008–2022 were identified (65 in PitchBook; ten further acquisitions were identified during verification); the annual number rose from three in 2008 to eighteen in 2022 (overall annual growth rate, 14%). During 2008–2010, five of seven acquisitions were of in vitro fertilisation providers; during 2020–2022, 22 of 39 were of clinics or clinic groups, including eleven of eighteen in 2022 (Box 1; Supporting Information).

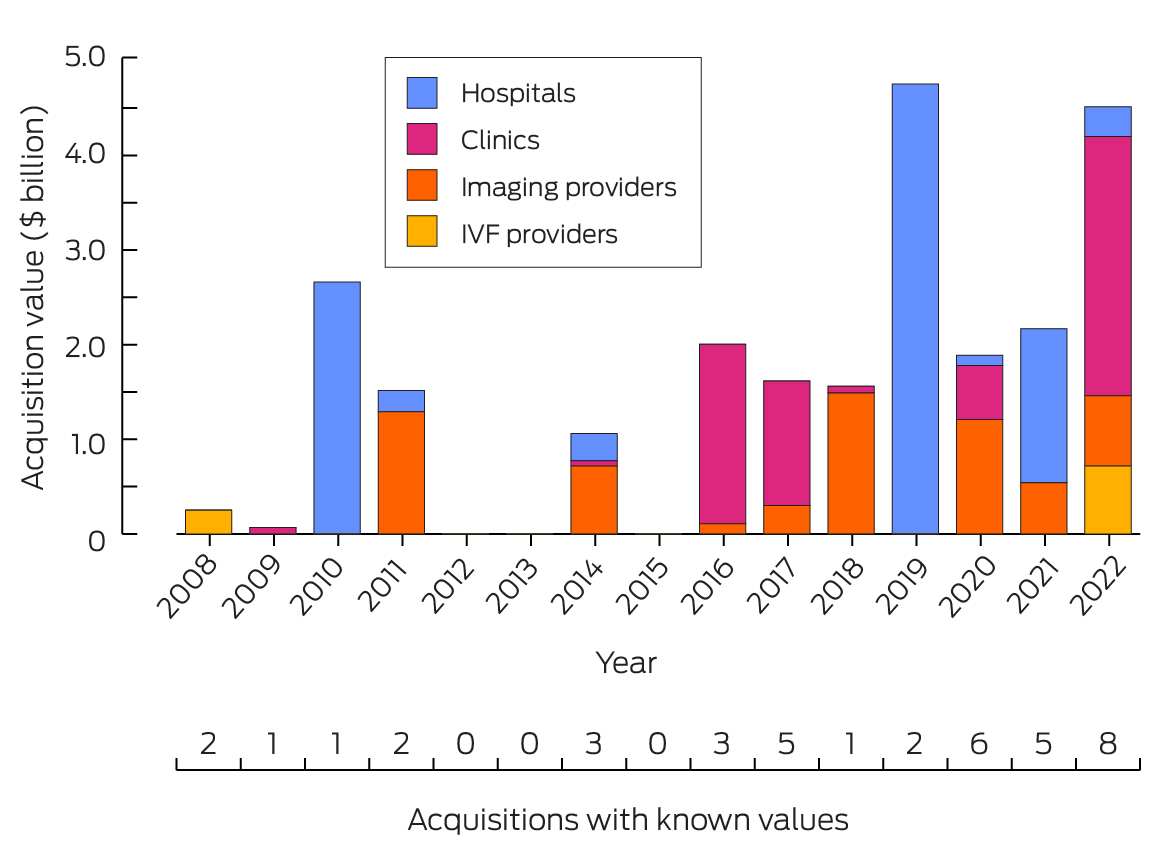

The purchase value was not available for 36 of the 75 acquisitions of Australian health care delivery organisations (48%) during 2008–2022. For the 39 acquisitions for which values could be ascertained, the estimated total value during 2008–2022 was $24.1 billion. Total known private equity investment in health care assets was $258 million in 2008, and $4.5 billion in 2022 (Box 2). The known sales value was dominated in some years by single purchases; for example, the purchase of Healthscope Limited in 2010 was the only identified acquisition during this year.

The medical specialty most frequently involved in private equity acquisitions of clinics during 2017–2022 was general practice: 16 of 54 identified private equity acquisitions and 256 of 445 clinics within purchases during this period (Box 3). These acquisitions ranged in size from single practices to large networks. The largest general practice acquisition was the sale of Fullerton Health (now: Partnered Health) by Fullerton Healthcare Corporation to Quadrant Private Equity in 2021, which at the time included more than 60 general practice clinics.

Seven ophthalmology clinic companies, including 24 clinics, were acquired. Four acquisitions of oncology clinic companies during 2017–2022 were identified, all related to Icon Group; 60 clinics changed owners, but some clinics were counted more than once because Icon Group was acquired twice, in 2017 and 2022. Between these dates, Icon purchased and incorporated at least three smaller oncology assets (add‐on acquisitions).

At least one hundred private practices were identified as being divested from the cardio‐respiratory unit of GenesisCare in 2022 and bought by Adamantem Capital, the only private equity acquisition of a cardio‐respiratory clinic during 2017–2022.

Of the twelve unique hospitals or hospital groups bought by private equity firms during 2008–2022, seven were still in private equity ownership in 2022 (the original buyer or a second private equity firm).

Discussion

Private equity investment in health care delivery has increased in Australia over the past fifteen years. Possible reasons include demand, health care industry, and private equity portfolio factors. Demand factors include an ageing population and the rising burden of chronic disease, each of which will increase the future need for health care.5 Industry factors include the highly fragmented nature of most health care delivery services, providing the opportunity for more consolidated firms to benefit from economies of scale and broad networks that increase their competitiveness. Portfolio factors could be particularly relevant in the wake of the coronavirus disease 2019 pandemic, which boosted recognition that health care is a relatively recession‐proof business and that health care assets can reduce risk in an investment portfolio.1,9 In addition, low interest rates have until recently eased access to capital, increasing private equity activity in general.13

Whatever the reasons for the recent growth, private equity investment in health care has not slowed in Australia. The focus of Australian private equity investment in health care assets differs somewhat from that in other countries. Dermatology, ophthalmology, anaesthesia, and emergency medicine are the leading specialties involved in private equity acquisitions in the United States.1 In Australia, private equity firms have also invested in ophthalmology, but much more in primary care. Radiology and imaging businesses have also been purchased by private equity buyers in Australia. Different health care payment and health care use dynamics may make Australian general practice networks and radiology businesses more attractive than those in the United States. Further assessment may clarify the reasons for the differences in investment preferences and the impact these acquisitions have on the use and costs of primary care and imaging in Australia.

Doctors can encounter private equity interests in different contexts. Some will be approached by private equity firms looking to buy their practices; others will be informed of a change in management because of new or changing private equity ownership; yet others may see practices in their area purchased and absorbed into larger competitors.

It is clear that private equity plays a major role in Australian health care delivery, and investigating its effects on health care is especially important given national attention to health care costs, particularly in the area of primary care. Based on the 2019 estimate of 8147 general practice clinics in Australia, about 2.6% of all general practices have been purchased by private equity owners since 2017 (including practices sold by one private equity owner to another, but adjusted for the 43 practices acquired twice).14 Given the scale of private equity investment in health care, more should be done to assess its local impact, particularly as American studies have identified negative outcomes in some contexts. Major differences between the payment and delivery characteristics of health systems mean, however, that extrapolating the findings of overseas studies to Australia is unlikely to be valid.

Limitations

The number of private equity acquisition deals during 2008–2022 may have been underestimated, as the information available from PitchBook is limited, and opportunistic finds during validation searches may not have discovered all acquisitions. The number of acquisitions may also have been underestimated because smaller acquisitions are not all announced online and consequently not included in the PitchBook database. The magnitude of the increase in acquisitions may be overstated because of recency bias in the comprehensiveness of the data in the PitchBook database. There may be more private equity‐owned assets than reported in this article, as purchases of private companies need not be made public in Australia. Finally, as many private equity firms do not report acquisition values, this information was available for only 52% of acquisitions.

Conclusion

The number of private equity acquisitions of Australian health care delivery assets increased during 2008–2022, particularly of general practice, imaging, and ophthalmology companies and clinics. Understanding the impact of private equity ownership on clinical care and costs in Australia is important. Doctors should be aware of the motivations and dynamics of private equity companies, as they are increasingly likely to interact with these firms and assets owned by these firms.

Box 1 – Number of private equity acquisitions of Australian health care delivery organisations, 2008–2022, by acquisition type

IVF = in vitro fertilisation.* The data for this figure are included in the Supporting Information, table 1.

Box 2 – Value of private equity acquisitions of Australian health care delivery organisations, 2008–2022, by acquisition type*

IVF = in vitro fertilisation.* The data for this figure are included in the Supporting Information, table 2.

Box 3 – Numbers of acquisitions of clinic companies and of individual clinics, Australia, 2017–2022*

|

|

Acquisitions (individual clinics within acquisitions) |

||||||||||||||

|

Medical specialty |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

Total |

||||||||

|

|

|||||||||||||||

|

General practice |

1 (43) |

0 |

0 |

3 (135) |

5 (71) |

5 (7) |

14 (256) |

||||||||

|

Ophthalmology |

0 |

0 |

0 |

0 |

4 (14) |

3 (10) |

7 (24) |

||||||||

|

Oncology |

3 (29) |

0 |

0 |

0 |

0 |

1 (31) |

4 (60) |

||||||||

|

Cardiorespiratory |

0 |

0 |

0 |

0 |

0 |

2 (101) |

2 (101) |

||||||||

|

Dermatology |

1 (4) |

0 |

0 |

0 |

1 (1) |

0 |

2 (5) |

||||||||

|

Total |

5 (76) |

0 (0) |

0 (0) |

3 (135) |

10 (86) |

11 (149) |

29 (446) |

||||||||

|

|

|||||||||||||||

|

* The numbers of clinic company acquisitions are higher in this table than the number of clinic acquisitions in Box 1 because some acquisitions comprised clinics from multiple specialties and are consequently counted several times in this table. |

|||||||||||||||

Received 5 March 2023, accepted 30 October 2023

- Victoria L Berquist1

- Harvard Kennedy School, Harvard University, Cambridge, MA, United States of America

Data sharing:

The data on which this report was based will be available to researchers with a methodologically sound proposal immediately following publication on application to the author at vberquist@alumni.harvard.edu.

Victoria Berquist is an employee of Boston Consulting Group, whose clients include private equity companies, but she was not working for the Boston Consulting Group at the time of research, authorship, or submission of the manuscript for this article. The contents of this article do not represent the views of Boston Consulting Group.

- 1. Brown EF, Adler L, Duffy E, et al. Private equity investment as a divining rod for market failure: policy responses to harmful physician practice acquisitions (USC‐Brookings Schaeffer Initiative for Health Policy). Oct 2021. https://www.brookings.edu/wp‐content/uploads/2021/10/Private‐Equity‐Investment‐As‐A‐Divining‐Rod‐For‐Market‐Failure‐15.pdf (viewed Mar 2023).

- 2. Cerullo M, Yang K, Joynt Maddox KEJ, et al. Association between hospital private equity acquisition and outcomes of acute medical conditions among Medicare beneficiaries. JAMA Netw Open 2022; 5: e229581.

- 3. Braun RT, Bond AM, Qian Y, et al. Private equity in dermatology: effect on price, utilization, and spending. Health Aff (Millwood) 2021; 40: 727‐735.

- 4. Resneck JS. Dermatology practice consolidation fueled by private equity investment: potential consequences for the specialty and patients. JAMA Dermatol 2018; 154: 13‐14.

- 5. Zhu JM, Polsky D. Private equity and physician medical practices: navigating a changing ecosystem. N Engl J Med 2021; 384: 981‐983.

- 6. Offodile AC, Cerullo M, Bindal M, et al. Private equity investments in health care: an overview of hospital and health system leveraged buyouts, 2003–17. Health Aff (Millwood) 2021; 40: 719‐726.

- 7. Gupta A, Howell ST, Yannelis C, Gupta A. Does private equity investment in healthcare benefit patients? Evidence from nursing homes (National Bureau of Economic Research Working Paper Series, no. 28474). Feb 2021; revised Aug 2023. https://www.nber.org/papers/w28474 (viewed Mar 2023).

- 8. Kannan S, Bruch JD, Song Z. Changes in hospital adverse events and patient outcomes associated with private equity acquisition. JAMA 2023; 330: 2365‐2375.

- 9. O'Donnell EM, Lelli GJ, Bhidya S, Casalino LP. The growth of private equity investment in health care: perspectives from ophthalmology. Health Aff (Millwood) 2020; 39: 1026‐1031.

- 10. Ikram U, Aung KK, Song Z. Private equity and primary care: lessons from the field. NEJM Catalyst, 19 Nov 2021. https://catalyst.nejm.org/doi/full/10.1056/CAT.21.0276 (viewed Mar 2023).

- 11. PitchBook. How do we get our data? https://pitchbook.com/research‐process (viewed Sept 2023).

- 12. Tan S, Seiger K, Renehan P, et al. Trends in private equity acquisition of dermatology practices in the United States. JAMA Dermatol 2019; 155: 1013‐1021.

- 13. Gompers P, Kaplan SN, Mukharlyamov V. What do private equity firms say they do? J Financ Econ 2016; 121: 449‐476.

- 14. Gordon J, Britt H, Miller GC et al. General practice statistics in Australia: pushing a round peg into a square hole. Int J Environ Res Public Health 2022; 19: 1912.

Abstract

Objectives: To examine the scale of private equity investment in Australian health care delivery assets (clinics, hospitals, imaging facilities, other doctor‐led health care services).

Study design, setting: Extraction of information about private equity acquisitions of hospitals, clinics, imaging centres and in vitro fertilisation facilities in Australia, 2008–2022, from a commercial database (PitchBook), supplemented by information from publicly available online media sources.

Main outcome measures: Number and value of private equity acquisitions of health care assets, 2008–2022; numbers of clinic parent company and clinic acquisitions, 2017–2022.

Results: A total of 75 private equity acquisitions of health care delivery assets in Australia during 2008–2022 were identified; the annual number rose from three acquisitions in 2008 to eighteen in 2022. During 2008–2010, five of seven acquisitions were of in vitro fertilisation providers; during 2020–2022, 22 of 39 acquisitions were of clinics or clinic groups, including eleven of eighteen in 2022. The total value of the 39 acquisitions for which purchase price could be ascertained (52%) was $24.1 billion. During 2017–2022, the clinic specialty with the greatest number of private equity acquisitions was general practice (256 of 446 clinics purchased within acquisitions). Seven companies owning ophthalmology clinics (24 clinics) were acquired by private equity. Four private equity acquisitions during 2017–2022 included 60 oncology clinics, all related to a single clinic group.

Conclusions: The number of private equity acquisitions of Australian health care delivery assets increased during 2008–2022. Doctors should be aware of the motivations and dynamics of private equity companies, as they are increasingly likely to interact with these firms and assets owned by these firms.